Social media is one way to use your voice. We are in the middle of a disruption from centralised top-down news sources to a model where everybody has the means to speak and reach out to everybody else. No state-sanctioned mass media required.

We let the opportunity slip away with Internet 2.0 where the large platforms captured the network effects and monetised the users. We have another try but can we do better this time?

It’s always time to build

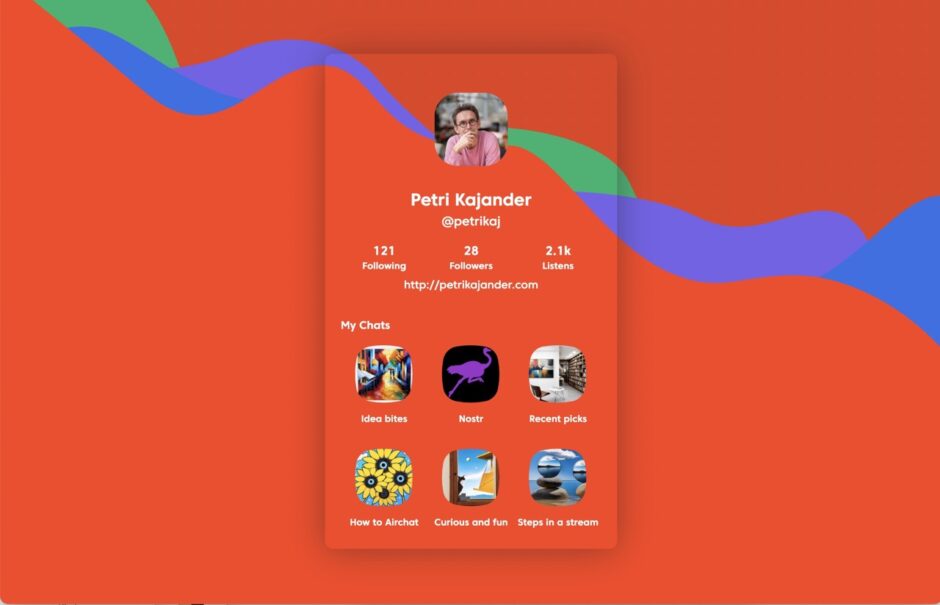

I noticed there was no easy way to share posts to decentralised networks. I built an app to share content to Bluesky, Mastodon and Nostr. If you can’t decide why not post to all?

Nootti is an iOS / iPad and M-series Mac app that makes posting and customisation easy for each network. AI content has started to flood all the channels. Real people with real messages become the exception.

You have a voice, use it

Freedom of speech needs to be exercised. If you have it today you may not have it tomorrow. If you take it for granted, don’t care about it or are too ignorant to use it you will notice when its gone. It’s harder to gain back once its gone.